AUDIO PODCAST

MUST READ

BEFORE YOU READ ON…

Let me ask you to pause and take a moment of context.

If you haven’t yet read the post linked above, please do. It lays the foundation for what you’re about to encounter here. Without it, you may mistake this for mere outrage or hyperbole. But with it, you’ll understand why this data is not just economic—it’s personal. It’s spiritual. It’s prophetic.

What follows is a collection of hard, unflinching truth. Truth that explains the invisible pressure crushing so many today. Financially. Emotionally. Spiritually.

Let me say something outrageous:

If your life today feels like a relentless grind just to survive… you’re not imagining it. You’re not weak. You’ve simply been born into a system where the rules were rewritten against you.

Here’s the shocker:

The real, inflation- and gold-adjusted wage of a minimum-wage worker in the 1970s would be the equivalent of $300,000 (or £250,000) today.

Sound ridiculous? That’s the point.

The fact that such a figure seems preposterous only proves how deeply we’ve been conditioned to accept exploitation. We’ve been trained to see crumbs as a feast. We’ve learned to feel shame instead of indignation.

Modern workers have become so used to systemic theft that fair compensation now sounds like fantasy. But it’s not fantasy. It’s history. It was normal. It was once expected.

In the next post, we’ll look deeper—not just at the external system, but the internal stronghold:

A slave mindset in people who are, in truth, heirs of the Kingdom of God.

And here lies the tragedy:

“My people are destroyed for lack of knowledge… because thou hast rejected knowledge.” — Hosea 4:6

“My people..,” not just he world, but God’s own people. That is, you and I!

Much of the ignorance in our time is not accidental. It is willful. Voluntary. Chosen. Convenient.

But you’re here reading this because something in you is waking up.

Keep reading.

JUST HOW FAR ARE YOUR BEHIND?

So what if I said to you, here is a yearly salary of $300,000 (or £300,000), how would that make you feel? Imagine it landing in your bank account. If you’re ecstatic, you’ve been duped into adopting a slavery mindset.

That figure-$300,000 (or £300,000)-only reflects the purchasing power of a 1970s blue-collar worker. In real, inflation-adjusted, asset-indexed terms, you’d be making the bare minimum, I.e. minimum wage.

The real issue? That wage feels abundant to us today because we’ve become spiritually and economically malnourished.

Dear Christian, the point I am making is this: We’re not aiming too high—we’re aiming far too low!

So what does the data have to say?

THE COLLAPSE OF WAGE VALUE: 1970 TO 2025

A Gold-Indexed Comparison of Real Wages, Tax Burdens, and Income Disparity in the US & UK

1. GOLD PRICE VS WAGES: THEN & NOW

Gold exposes the truth about currency. It is immune to fiat manipulation. Governments can’t simply print more of it. Let it be the prophet in our economic debate.

| Year | Gold Price (USD/oz) | UK Weekly Wage (£) | UK Yearly Wage (£) | UK Gold Buying Power (oz/year) | US Weekly Wage ($) | US Yearly Wage ($) | US Gold Buying Power (oz/year) | Shortfall in actual (gold based) value |

|---|---|---|---|---|---|---|---|---|

| 1970 | $35 | £28.50 | £1,482 | 42.34 oz | $108 | $5,616 | 160.46 oz | -118.12 |

| 2025 | $2,400 | £429.00 | £22,308 | 9.30 oz | $944 | $49,088 | 20.45 oz | -11.15 |

NTERPRETATION

- In 1970, a UK manual worker could afford 42 oz of gold/year. Today? Just 9.

- A US worker could afford 160 oz/year in 1970. Now? Barely 20.

- Wages haven’t just stagnated. They’ve collapsed in real terms.

That shortfall isn’t merely a gap in gold reserves. Gold possesses intrinsic value—it is a tangible, real asset, unlike the paper bills and digital figures we are often led to believe represent true wealth.

When fiat currencies lose their worth, liquidity invariably flows into gold as a reliable hedge against inflation. Just take a look at the gold holdings of governments over the past seventy years or so—what that reveals about trust, value, and economic stability is profound.

This impact goes far beyond your net worth—it touches your quality of life, your stress levels, your health, your relationships, the very fabric of society, and even your connection with God.

When stress takes hold, you slip into survival mode, triggering your most primal instincts. In that state, God is often pushed to the margins, squeezed out by fear and anxiety and the impulse of survival.

This is not what God desires for you. He does not want you to live under the crushing weight of fear, stress, and survival instinct. When you find yourself trapped in this relentless cycle, it is a clear symptom of something far more sinister at work.

You are, in truth, under the heavy boot of the Pharaoh of this world—the enemy, Satan—who prowls like a roaring lion, seeking whom he may devour. As Scripture warns, he comes only to kill, to steal, and to destroy (John 10:10).

This oppressive force aims to rob you of your peace, your purpose, and your destiny in God. But remember, the Kingdom of God is freedom, abundant life, and victory over fear. You are called to rise above this bondage, to reclaim your identity as a beloved child of God, and to walk in the liberty He offers.

That is why understanding this article is so vitally important.

You might believe the value of gold has little to do with you—but consider what governments around the world are actively doing. The following historic table of gold holdings reveals a remarkable surge since the year 2000, reaching record-breaking levels. And make no mistake—the buying frenzy is far from over; in fact, it’s only just beginning to warm up.

| Year | Approximate Gold Purchased by Central Banks/Governments (Metric Tonnes) | Notes / Context |

|---|---|---|

| 1950-1960 | ~300–400 tonnes per year (estimated) | Post-WWII gold standard era, heavy official holdings |

| 1961-1970 | ~200–300 tonnes per year (estimated) | Bretton Woods system weakening |

| 1971-1980 | 100–200 tonnes per year | End of gold convertibility in 1971; gold price spikes |

| 1981-1990 | ~50–100 tonnes per year | Western central banks net sellers |

| 1991-2000 | ~20–50 tonnes per year | Massive selling by central banks (“central bank gold sales agreements”) |

| 2001-2010 | 100–200 tonnes per year | Reversal to buying trend, rising demand post-9/11 |

| 2011-2020 | 400–600 tonnes per year | Strong buying mainly by emerging markets (China, Russia, Turkey) |

| 2021-2023 | ~450–550 tonnes per year | Continued purchases by Russia, China, and others |

WHAT THIS MEANS

- 1950s-60s: Central banks, especially in Europe and the US, held vast gold reserves under the Bretton Woods system; most gold was stored by governments.

- 1971: US ended gold convertibility, gold price freed, causing volatility in central bank holdings.

- 1980s-1990s: Many Western central banks sold large portions of their gold reserves to support fiat currency systems.

- 2000s onward: Shift back to accumulation as trust in fiat currencies wavered; major buyers include Russia, China, India, Turkey, and some Middle Eastern countries.

This means they are exchanging make-believe money—fiat currencies backed by nothing—for real, tangible wealth: gold!

What does that say about their view on inflation, the economy, and the value of what the common man calls “money,” but isn’t?

PURCHASING POWER

So, how much would you need to earn today to enjoy the same purchasing power that a blue-collar worker had back in the 1970s?

REQUIRED WAGE IN 2025 TO MATCH 1970 PURCHASING POWER

| Country | Gold Target (oz/year) | Gold Price (2025) | Needed Wage | Actual Wage (2025) | Gap |

|---|---|---|---|---|---|

| UK | 42.34 oz | $2,400 | £101,616 (?) | £22,308 | -£79,308 |

| USA | 160.46 oz | $2,400 | $385,104 | $49,088 | -$336,016 |

It’s economically sound to say that an income of $300,000 or pounds Stirling, today merely matches the lifestyle a minimum-wage worker could afford in the 1970s. And keep in mind, that figure represents only the average—far from exceptional. The oft-cited amount of £101,616 is misleading, because we no longer live in isolated national economies. In today’s global market, a more accurate benchmark for a minimum-wage worker’s “average” income would be closer to £300,000.

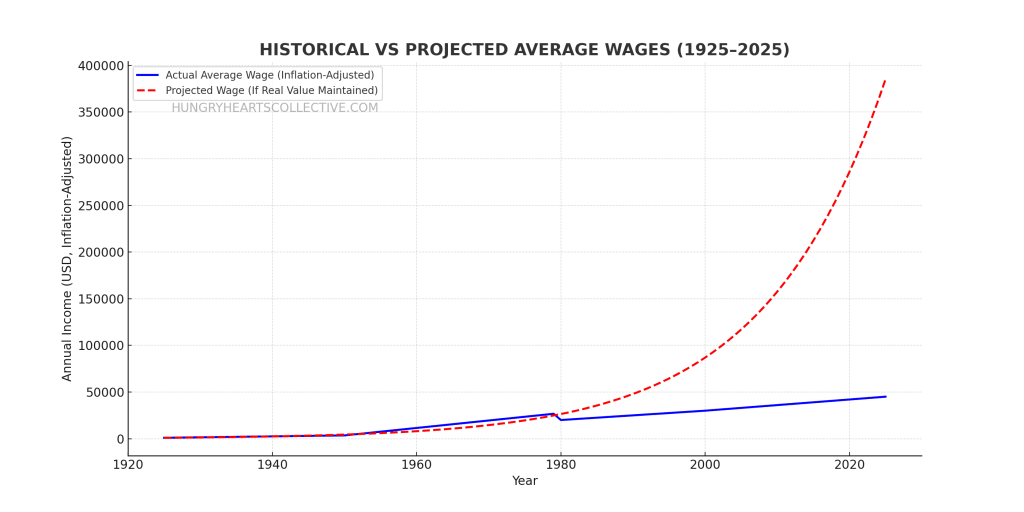

Consider the following graph.

HISTORICAL VS PROJECTED AVERAGE WAGES (1925–2025)

EXPLANATION

- Blue Line: Actual inflation-adjusted average wages.

- Red Dashed Line: Projected wages if they had kept pace with gold or productivity growth.

- The Divergence: The actual wages and projected wages began to diverge shortly after the dollar—and subsequently all other currencies—were unpegged from the gold standard in 1971.

So where has all that extra money gone—the wealth quietly siphoned from the unwitting worker over the decades? Who’s holding it now? If productivity has soared, if we’re working harder and longer than ever, yet struggling more—then someone is harvesting the surplus. The question is no longer if you’ve been robbed, but who is holding the stolen inheritance.

Let’s have a look-see.

WEALTH DISTRIBUTION TODAY

| Group | 🇺🇸 USA | 🇬🇧 UK |

|---|---|---|

| Top 1% | 42.7% | 20% |

| Top 10% | 72%+ | 48.6% |

| Bottom 80% | 7% | <10% |

OR MORE STARKLY:

| Group | 🇺🇸 USA |

|---|---|

| Top 1% | ~70% |

| Top 40% | ~27% |

| Bottom 80% | ~3% |

This means that the bottom 80% are, in effect, poor—living on the edge of bankruptcy. And if that sounds dramatic, consider this: over 55% of UK households now receive more in benefits and financial aid than they pay in taxes—despite working full-time jobs. Do you see the problem? We’re not looking at laziness or lack of effort—we’re looking at a system that’s fundamentally broken. One where full-time work no longer guarantees dignity, security, or true ownership.

And it doesn’t stop there. Minimum-wage workers today are taxed more heavily than they were seventy years ago. And while wages appear to be rising, that growth is deceptive—it’s not real purchasing power that’s increasing, just the number of debased pounds. Meanwhile, the Prime Minister is talking about freezing tax bands. But what does that actually mean?

It means that as inflation pushes nominal wages higher—not because people are earning more, but because the currency is worth less—workers are dragged into higher tax brackets. They’re penalised for earning inflated, powerless money. If the system were just, tax thresholds would rise with the cost of living. But instead, the state pretends you’re richer, taxes you like you’re wealthier, and leaves you poorer.

INCOME TAX ON MINIMUM WAGE: THEN VS NOW

| Country | Year | Earnings | Effective Tax | Notes |

|---|---|---|---|---|

| USA | 1970 | $5,616 | ~14% | Modest federal tax & FICA |

| USA | 2025 | ~$25,000 | ~15-20% | Fed + state + FICA |

| UK | 1970 | £1,482 | 0% | Below threshold |

| UK | 2025 | £22,308 | ~13-14% | Income Tax + NIC |

Today’s poor pay more tax in real terms than yesterday’s rich. That’s not hyperbole—it’s the economic reality hidden in plain sight.

Not only is the modern minimum wage a mere fraction of what a 1970s blue-collar worker earned in real, inflation-adjusted purchasing power, but it’s also burdened with heavier taxation. The working poor are not just earning less—they’re keeping less of that already diminished income.

This is why it feels like you’re fighting a losing battle: because you are. You are running uphill against a system rigged to extract more from those who have less, and to funnel it upward into the hands of those who already have more than enough.

So who does get the tax cuts? Not you. Not the working poor. Not the small family trying to survive on honest labour.

No—the tax breaks go to the corporations. The same corporations paying minimum wage while raking in record profits. They pay the bare minimum in tax, not because they’re playing fair, but because they have access to elite tax specialists—and the quiet backing of the very ministers who are supposed to regulate them. Ministers who, all too often, slide effortlessly into high-paying “consulting” roles with these same corporations once their political careers are over.

It’s a revolving door of privilege and protection. And you? You’re left footing the bill. Struggling under the weight of frozen thresholds, inflated currencies, and a system designed to reward wealth while punishing work.

This isn’t just corruption. It’s betrayal.

What you’re experiencing isn’t just bad luck or personal failure. It’s economic warfare waged quietly, through stealth inflation, frozen tax bands, and false narratives of progress. And the first step toward reclaiming your dignity, your peace, and your future is to see this system for what it is—and refuse to play by its rules any longer.

So that is the bad news, what is the good news?

WITHOUT GOD, YOU ARE WASTING YOUR TIME

“Except the Lord build the house, they labour in vain that build it: except the Lord keep the city, the watchman waketh but in vain.” — Psalm 127:1

If forsaking God is the root of the problem, then returning to Him—what Scripture calls repentance—is the only true solution. We were never created to serve Pharaoh. We were never meant to be slaves to a system that devours our time, our strength, our peace, and our identity.

Why labour under the whip of Babylon, toiling for crumbs in a collapsing empire, when you’ve been called to live as an heir in God’s house?

Jesus didn’t die to make you a more productive slave. He died to make you a son, a daughter—royalty in the Kingdom. The prodigal returned to his Father not with riches, but with humility. And what did he receive? Not punishment, but a robe, a ring, a feast.

The way out isn’t more hustle. The way out is surrender. Return to the Source. Come out of the world’s economy, and step into the provision, rest, and inheritance of the Father

This economic crisis is not merely structural—it is spiritual. The economic crisis isn’t the problem it is a symptom. We have built our financial systems, our careers, and our futures on sand, not rock. We have trusted in markets, policies, and inflation metrics, but not in God.

And if we did that, we can also do something different if we wanted to.

What data shows is not just the collapse of wages—it is the collapse of a worldview. A secular economy cannot save a spiritual people. Without God, the modern world offers only illusion: activity mistaken for progress, numbers mistaken for value.

The painful truth is this: we are labouring in vain. More hours, more degrees, more side hustles—and yet less peace, less freedom, less fruit. Unless the Lord builds the economy—unless Christ is at the centre—no wage increase will ever buy back the dignity-and sovereignty-we have lost.

It’s not just that fiat currency is unstable. It’s that human confidence without divine foundation is doomed to fail.

Now is the time to return, to rebuild the economy of our hearts, our homes, and our nations on the Word of God.

At first glance, it seems workers are putting in fewer hours. But this is misleading. The decline in reported hours is partly due to the fragmentation of full-time jobs into gig-based, part-time, and precarious roles. Many workers now hold multiple jobs just to make ends meet.

AVERAGE NUMBER OF JOBS PER WORKER (USA)

A total of 8.3 million Americans work multiple jobs, according to 2024 data from the BLS, showing clear discrepancies between demographics. The workweek may be shorter on paper, but the hustle is endless in practice. This is not liberation from labour—it’s a multiplication of fragmented toil.

KEY STATTISTICS

- 8.4 million people in the U.S. (5.2% of the employed population) work more than one job.

- Women are more likely to work multiple jobs: 5.2% of women (434,000) aged 20-24 hold two or more jobs.

- African American women are most likely to work two or more jobs.

- 5.7% of women vs. 4.7% of men hold multiple jobs.

- Black or African Americans have the highest rate of multiple jobholding at 5.8%.

- Asian Americans have the lowest rate of multiple jobholding at 3.6%.

- Widowed, divorced, or separated individuals have the highest rate at 5.5% compared to married and single people.

- Nearly 2 million people manage two part-time jobs, while 376,000 Americans work two full-time jobs.

While average hours have declined slightly on paper, this does not mean workers are doing less. Instead, the intensity and expectations of work have increased significantly—from emotional labour to digital availability beyond contracted hours.

WORKING CONDITIONS

The modern labour landscape has not only shifted in hours but in security, pressure, and dignity. Reports from the ILO, OECD, and UK ONS confirm:

- Permanent jobs have steadily given way to zero-hour, gig economy, and freelance contracts.

- Many roles now expect ‘unpaid availability’, meaning being on-call or responsive even outside hours.

- The rise of “emotional labour” (customer service, social media, etc.) has pushed workers to perform feelings, not just tasks.

- Work-from-home and hybrid models have blurred the boundaries between rest and toil.

In the 1970s, one income could support a household. Today, two full-time incomes barely cover rent.

The system says we’re working less (employment strategy). In truth, we’re working more—for less security, fewer benefits, and far less rest.

CEO’S VS WORKERS

Here is yet another sobering graph—a visual indictment of the economic story few are willing to tell plainly. Over the past half-century, a quiet but devastating transformation has taken place. Wages have stagnated. Job security has eroded. Gig work has replaced stable careers. And all the while, the cost of living has marched steadily upward, untethered from the average person’s ability to keep pace.

Those who have taken the time to study the language of money—who have trained themselves to think in terms of assets, equity, and ownership—have seen through the illusion. They are the business leaders, investors, and strategic thinkers who understand the rules of this hidden economy. They do not depend on wages alone. They are not entrapped by the promise of “job security” or pension stability, because they know these promises are no longer backed by reality.

Meanwhile, the average employee—faithful, overworked, and increasingly atomised—is being caught in a system that has quietly shifted beneath their feet. What was once a linear path from hard work to stability and retirement has become a labyrinth of part-time contracts, unstable benefits, and postponed dreams.

The trap has been set not with chains, but with expectations: the expectation that the old model still works… that loyalty will be rewarded… that saving 5% of your income in a retirement plan will be enough… that governments will always be able to make good on their promises.

But the numbers tell a different story. And the graph does not lie.

| Year | US CEO Pay | US Avg Worker | Ratio |

|---|---|---|---|

| 1965 | $832,000 | $40,200 | 20:1 |

| 1978 | $1.48m | $48,000 | 30:1 |

| 1989 | $2.76m | $45,400 | 59:1 |

| 2000 | $20.38m | $48,700 | 372:1 |

| 2022 | ~$25m | ~$60,000 | 344–399:1 |

In the UK, the 1978 CEO-to-worker ratio was 9:1. By 2002? Over 54:1. Now? Likely 80–100:1.

While your wage stayed the same, theirs multiplied by 1,000%.

THE DOUBLE INCOME TRAP: EMANCIPATION OR ENSLAVEMENT?

With the rise of so-called emancipation, we now have two people per household working full-time jobs—yet many families can afford less than what a single breadwinner could provide in the 1970s. What was once achievable on one modest income—home ownership, savings, holidays, and raising a family—is now out of reach for most, even with both parents working.

But this isn’t just an economic issue. It’s spiritual. It’s relational. It’s civilisational.

Children are no longer raised by present, loving parents, but by screens, state schools, and the algorithms of social media. In the absence of mothers and fathers—physically absent, emotionally exhausted, spiritually drained—the world steps in. The system steps in. The State steps in. And behind that facade of “modern life” lurks a darker reality: the devil himself.

Let’s not be naïve. This is not progress—it’s quiet collapse.

We’re witnessing the fabric of society being ripped apart at the seams by the kingdom of Satan, under the guise of freedom, empowerment, and progress. But how can this end well? It can’t. Because when the foundations are destroyed—when God’s order for life, family, rest, and stewardship is cast aside—chaos fills the void.

The solution isn’t working harder or earning more. It’s coming home. It’s rebuilding on the Rock. It’s returning to God’s design, His economy, and His rhythm for life. Only then can we restore what’s been lost and reclaim what was stolen.

WHY GOLD—AND ITS OWNERSHIP—MATTERS

Gold is not just an asset. It is a mirror. A test. A keeper of truth.

In every generation, gold has functioned as a counterweight to the deceit of paper promises. Empires have risen and fallen on the ability to control—or to abandon—the gold standard. Why? Because gold cannot be printed, manipulated, or devalued by decree. It is immune to inflation’s deception. It exposes the illusion of progress when wages rise on paper but fall in reality.

When God told the Israelites to build His temple, they overlaid it in gold—not out of vanity, but as a signal: what is holy must also be weighty and incorruptible. Gold is used throughout Scripture as a symbol of kingship, purity, and divine approval.

“The silver is mine, and the gold is mine, saith the Lord of hosts.” — Haggai 2:8

To own gold is not about greed; it is about remembrance. It anchors our economy in reality, not illusion. It reminds us that true wealth must be backed—not by government trust—but by integrity, scarcity, and truth.

WHAT IS INFLATION?

When someone purchases a home for $180,000 and sells it fifteen years later for $1.8 million, they often believe they’ve made a substantial profit. But this perception is misleading. What appears to be a gain is, in truth, a mirage. The property itself has not suddenly become ten times more valuable in any intrinsic sense. What has changed is the value of money—or more precisely, its loss of value.

This is not appreciation. It’s monetary dilution. Which in simply terms means: you need more of it to buy the same thing.

Since 1971, when the United States officially detached the dollar from the gold standard, we entered a new era of fiat currency—money no longer backed by anything of tangible, fixed worth or value—only a promise and the publics belief in that promise. From that moment, the floodgates were opened. Governments could expand the money supply at will through mechanisms like quantitative easing, low interest rates, and deficit spending. And they have done so with vigour.

Since the U.S. left the gold standard in 1971, the purchasing power of major fiat currencies has dramatically eroded:

| Currency | Loss of Value Since 1971 | Current Purchasing Power |

|---|---|---|

| U.S. Dollar | ~87% lost (since 1 → 0.13) | $0.13 today buys what $1 did in 1971 |

| British Pound | ~94% lost | £0.06 buys what £1 did in 1971 |

What looks like asset growth (e.g., home values rising from $180k to $1.8m) often mirrors currency debasement, not real “intrinsic value” gains. Holding fiat over decades without appreciating assets or inflation hedges means losing real money.

The result? Each newly printed dollar renders all previous dollars slightly less valuable. And while the impact of that devaluation may feel subtle in the moment, over decades, it compounds into a profound erosion of purchasing power. The rising cost of homes, groceries, fuel, tuition, and nearly every essential is not simply “inflation”—it is the visible symptom of a deeper disease: the systematic debasement of the currency.

But this is only half the story.

While the cost of living has surged, real wages—adjusted for purchasing power—have not kept pace. Yes, the nominal numbers have risen, but the average worker can now afford far less with their paycheque than a worker fifty years ago could. The illusion of progress hides a brutal truth: in real terms, the modern wage earner is running uphill on a treadmill that keeps accelerating.

This sets the stage for a slow-motion collapse.

Why? Because those with disposable income—those already ahead—are able to purchase assets. Not necessarily assets that skyrocket in intrinsic value, but ones that at least keep pace with inflation: property, equities, commodities, and other inflation-resistant vehicles. These assets act as lifeboats, preserving wealth amid the rising tide of monetary dilution.

Meanwhile, those with shrinking disposable income—the majority—cannot afford to buy in. They remain trapped in a cycle of renting, spending, and surviving, while the value of their labour buys them less and less with each passing year. The result is a widening wealth divide, not simply driven by effort or talent, but by unequal access to the tools of financial preservation.

This is not just inequality. It is structural erosion—a system in which the rules are subtly rigged against those who live paycheque to paycheque, while rewarding those who already hold equity in the game.

And unless something shifts—radically—this silent collapse will continue, hidden behind headlines of growth and GDP, while the foundation crumbles beneath the average household.

Today, we have elaborate social safety nets designed to catch those who, without intervention, would be utterly destitute. But let’s ask the uncomfortable question: why are so many people in need of catching in the first place?

The answer is sobering. It’s not because they’re lazy. It’s not because there’s a shortage of work. It’s because many of today’s jobs no longer pay a living wage.

Corporations—many of them highly profitable—routinely compensate workers at levels that are insufficient to meet even basic living standards. And so, governments step in to fill the gap: housing benefits, food assistance, tax credits, and subsidies for working families. But where does this public support come from?

From you. From me. From the public purse.

In effect, the taxpayer is subsidising the wage bill of private companies—not out of generosity, but because the system has quietly arranged itself that way. Profits are privatised, funnelled upward to shareholders and executives, while the liabilities—the human costs of underpaid labour—are socialised, handed off to the government, and ultimately, the public.

This is economic sleight of hand. The average citizen believes they are helping the poor—when in reality, they are covering the shortfall left by corporations that refuse to pay their fair share.

It is a quiet form of wealth extraction—one that hides behind bureaucracy and policy, but which amounts to a transfer of responsibility: away from those who profit, and onto those who have no say in the system’s rules.

The result? A society where the working class bears not only the weight of their own survival, but also the burden of propping up an economy that is systematically tilted against them.

So, when that home sells for ten times its original price, the owner has not truly earned a windfall. They have merely preserved purchasing power in a system where the money itself is quietly evaporating in value.

Understanding this distinction is crucial. If we mistake inflation for profit, we will miscalculate everything—our retirement needs, our investment strategies, and ultimately, the true state of our wealth.

The modern world, since abandoning gold, has also abandoned the very concept of objective value. Everything is now subjective—your truth, your worth, your price. Gold is truth.

But gold says otherwise. Gold is not opinion. It is what it is. Like God.

To store your wealth in gold is, in some sense, to rebel against the false balances of the age. It is to say: “I will not be lied to. I will not measure myself by inflated numbers, but by righteous standards.”

Here’s the expanded section you requested, divided into two parts and styled to match the eloquent, data-rich, and spiritually aware tone of the rest of your blogpost:

HIDDEN TAXES: THE INVISIBLE DRAIN ON YOUR LABOUR

When we speak of taxes, most people think only of income tax or National Insurance. But the modern worker is bled dry not just by what is taken from their paycheck, but by what is siphoned off at every step of life. These hidden taxes are the silent assassins of financial freedom. They do not show up as line items on your payslip—but they devour your livelihood all the same.

Let’s name a few:

Here is the fully updated and expanded Hidden Taxes Table, refined for clarity, eloquence, and completeness. It fits seamlessly into the existing blogpost tone:

HIDDEN TAXES: THE INVISIBLE DRAIN ON YOUR LABOUR

| Tax Type | Description |

|---|---|

| VAT | Value Added Tax – 20% on most goods and services in the UK (similar to sales tax in the US). |

| Fuel Duty | UK drivers pay ~52p per litre plus VAT on top. One of the highest fuel taxes in the world. |

| Toll Roads | Charged simply for using public infrastructure you already paid to build. |

| MOT, Road Tax, Toll Roads, ULEZ & Parking fees | Annual fees required just to legally own and operate a vehicle. |

| Council Tax | £1,000–£3,000+ per year, paid from net income, and rising yearly regardless of service level. |

| TV Licence | A legally enforced £169.50/year fee just to own a television or watch BBC content. |

| Import Duties | Hidden costs embedded in clothing, electronics, food, and online orders from abroad. |

| Stamp Duty | Tax on buying a home—scaling steeply, especially in cities—paid in cash on top of deposit. |

| Licensing Fees | Required for everything from trades, business operation, events, or even playing music publicly. |

| Prescription Charges | Despite the NHS, many still pay out-of-pocket for medications or resort to private doctors due to waitlists. |

| Inheritance Tax | Up to 40% of estates over the threshold are taken by the state—taxed again after a lifetime of already-taxed income. |

Every loaf of bread. Every litre of petrol. Every step on a public road. You’re taxed.

You are taxed when you earn, taxed when you spend, taxed when you save, and taxed when you die.

And what does Scripture say?

“Woe unto you… who make men to labour under burdens you yourselves would not lift with one finger.” — Luke 11:46 (paraphrased)

We are living in a system of layered burdens, carefully designed to appear invisible. The result? Even the poor must subsidise the state, and those with the least are taxed proportionally more.

This is not fiscal prudence. It is economic oppression masquerading as modernity.

THE PENALTY OF AMBITION: HOW STRIVING COSTS MORE THAN IT EARNS

If you try to better your life—study harder, work longer, climb higher—you will discover something strange: the system punishes your progress.

Let’s break it down.

| Action | Additional Cost |

|---|---|

| Go to university | Student debt: £40,000+ (UK), $50,000–$200,000 (US). |

| Earn more | You move into a higher tax band, losing 20–45% of every extra £/$. |

| Start a business | VAT thresholds, corporation tax, accountancy, compliance fees. |

| Buy property | Stamp duty, land tax, mortgage interest. |

| Improve yourself | Courses, licenses, tools—all paid for after-tax. |

What you thought would free you—education, promotion, success—only ties you tighter to the grind.

The better you do, the more you are penalised.

“You earn more… but you don’t keep more. You’re climbing a ladder leaning on the wrong wall.”

Consider:

- A UK worker earning £50,000 pays 20% income tax, plus ~12% National Insurance, plus student loan repayments.

- Then comes council tax, VAT, fuel, broadband, insurance—all paid from post-tax income.

- Their real disposable income? Often less than someone earning £30,000 who receives benefits and avoids loan repayments.

So why work harder?

Because we’ve been sold the lie that hard work alone brings freedom. But Scripture says otherwise:

“It is not by might, nor by power, but by my Spirit.” — Zechariah 4:6

We are not meant to strive endlessly in Babylon. We are called to thrive in the Kingdom.

SPIRITUAL COMMENTARY

WHEN THE BALANCES LIE: A PROPHETIC INTERPRETATION

“A false balance is abomination to the Lord: but a just weight is his delight.” — Proverbs 11:1

The data is not merely economics. It’s a divine x-ray. A spiritual indictment.

Gold, the symbol of incorruptible value, reveals that our system is corrupt. Our labour has been devalued, not because we’ve done less, but because the scale was tampered with.

In 1971, the world abandoned gold. But deeper than that, it abandoned God. Fiat currency is belief without backing. It is faith in man, not in Heaven. Since then, the world’s scale has lied.

“Behold, the wages… kept back by fraud, crieth” — James 5:4

Theft, camouflaged as prosperity. Labour, disguised as freedom.

RETURN TO RIGHTEOUS WEIGHTS

“Thou shalt not have in thy bag divers weights, a great and a small… But thou shalt have a perfect and just weight, a perfect and just measure shalt thou have…”

— Deuteronomy 25:13–15

The world we live in is built on dishonest scales. The economy of Pharaoh thrives on deception—on unequal weights, false promises, and ever-shifting definitions of value. We are weighed and taxed in debased currency, paid in numbers divorced from worth, and told it is freedom while we labour under invisible chains.

But here’s the truth: we are not called to reform Pharaoh’s system.

We are called to come out from it. And the good news? We can.

Because the only part of this world we truly have control over… is ourselves.

We must become the alternative economy.

An economy where value is rooted in worth, not in optics.

Where work is worship, not wage slavery.

Where wages lead to stewardship, not survival.

Where the weights are just, and the scales reflect God’s justice.

This isn’t just an economic message. It’s not merely political.

It’s personal—because it begins with how you see yourself.

You are not a cog.

You are not a commodity.

You are not a slave in Babylon’s machine.

You are an heir of God. And heirs must live differently.

We cannot seek the kingdom of Mammon and expect the peace of Christ.

“But seek ye first the kingdom of God, and His righteousness, and all these things shall be added unto you.”

— Matthew 6:33

The economy of heaven begins with order: God first, all else flows.

Not just in theory, but in practice—how you budget, how you work, how you rest, how you give.

You cannot live like a king if you think like a slave.

A FINAL CALL: CHOOSE YOUR ECONOMY

The collapse you feel isn’t just financial—it’s spiritual. It’s not just about money. It’s about identity, authority, and worship. And you can return to wholeness. You can live under righteous weights.

But you must start by returning to God.

Through faith. Through prayer. Through obedience.

You do not have to save the system. But you do have to step out of it. And the moment you do, your life will begin to reflect the abundance of the Kingdom—not because it’s easy, but because it’s righteous.

So ask yourself today:

Whose economy am I living in?

Whose scales am I trusting?

Whose yoke am I bearing?

Return to God. Return to righteousness.

And watch as He restores what the enemy devoured.

DEVOTIONAL PRAYER

Heavenly Father,

You are the God of perfect justice and unwavering truth.

In a world of false scales and shifting values, help me to stand firm in Your righteousness.

Teach me to seek Your Kingdom above all else, to trust in Your provision,

and to live as Your heir—with integrity, purpose, and peace.

Free me from the lies of this world’s economy and renew my heart to worship You in all I do.

May my work be an offering, my stewardship faithful, and my life a testimony of Your abundant grace.

In Jesus’ name, Amen.

KEY STATEMENT

True wealth begins when we live by God’s righteous standards, not by the world’s counterfeit measures.

MEMORY VERSE

“But seek ye first the kingdom of God, and his righteousness; and all these things shall be added unto you.”

— Matthew 6:33 (KJV)

QUESTIONS FOR REFLECTION

- In what ways have I internalised the world’s definition of value?

- How can I align my financial life with God’s justice?

- Am I stewarding my labour—and the labour of others—in righteousness?

- Where might I be trusting in “fiat promises” rather than eternal provision?

- What does it look like for me to build God’s economy in my home, work, and community?

MORE

LIKE & SUBSCRIBE

Leave a comment