AUDIO PODCAST

SUMMARY—MANAGED DECLINE

The cascade of symptoms in the West, particularly the UK, is not random, but deeply interrelated. They are signs of a much larger and more insidious breakdown. It mirrors what engineers or ecologists might call a systemic failure, where one part collapsing triggers a domino effect throughout the entire structure. Economically and socially, we are witnessing a deterioration that is not accidental but orchestrated or, at the very least, tolerated under the banner of “managed decline.” This phrase, often repeated in political corridors, is not merely a euphemism but a quiet admission: the system is no longer designed to lift its citizens and build society up, but to gradually lower expectations, redistribute wealth upward, and preserve power through erosion rather than growth.

Understanding this systemic cascade helps us interpret the chaos: it is not madness; it is method—the slow drip of a paradigm shifting from liberty to control.

This is musical chairs with high stakes. The tune’s nearly over, and not everyone gets to sit down.

JESUS SAVED YOUR SOUL—NOW LET HIM DELIVER YOUR WALLET

I am writing this post because it seems to me that too many Christians still have not realised what it means to be part of the world’s system of economics, and why Paul says to,

“not be conformed to the pattern [of slavery] in the world, but to be transformed by renewing [correcting] your mind” (Romans 12:2).

Before we begin, if you haven’t yet read the previous blog post, “Saved? From What?”, please do. It frames the spiritual lens through which this entire post must be understood.

In it we found out that if you wanted to live the same lifestyle today as a 1970s blue-collar worker, you’d need to earn over £300,000 (or $300,000 USD) per year.

If that sounds outrageous, it’s only because we’ve been conditioned to accept economic slavery as normal. The lie is so deeply embedded that justice feels like luxury, and fair wages feel like fantasy.

This isn’t overreach—it’s catch-up.

This isn’t about dreaming big. It’s about waking up.

Remember, you can’t escape something you don’t understand.

Now, brace yourself. Let’s go deeper.

THE MYTH OF HIGH SALARIES: WHAT DO YOU REALLY KEEP?

Following is what the world considers normal:

| Gross Salary (£) | Income Tax | NI Contributions | Post-Tax Income | Est. Hidden Taxes(VAT, Council Tax, etc.) | Actual Disposable Income | % of Salary You Keep | Is This Livable? |

|---|---|---|---|---|---|---|---|

| £15,000 | £0 | £520 | £14,480 | £4,000 | £10,480 | ~70% | 🚨 Not Livable |

| £25,000 | £2,486 | £1,651 | £20,863 | £5,000 | £15,863 | ~63% | ⚠️ Borderline |

| £40,000 | £6,486 | £3,651 | £29,863 | £6,000 | £23,863 | ~60% | ✅ Just Surviving |

| £60,000 | £11,432 | £5,108 | £43,460 | £7,000 | £36,460 | ~61% | ✅ Livable |

| £100,000 | £26,432 | £5,108 | £68,460 | £10,000 | £58,460 | ~58% | 💰 Basic Income |

| £150,000 | £49,460 | £5,108 | £95,432 | £14,000 | £81,432 | ~54% | 💰 High Income |

| £250,000 | £89,460 | £5,108 | £155,432 | £20,000 | £135,432 | ~54% | 💰 Very High Income |

And if you are still telling yourself that that is your take home pay, consider the following:

Here is a table exposing “Hidden Taxes” — the daily, often-overlooked ways we are taxed even outside of income tax. This reveals the many layers of Pharaoh’s economic system, where the burden is subtly placed on the people under the guise of “services.”

HIDDEN TAXES IN EVERYDAY LIFE

| Category | Hidden Tax / Fee | Description | Who Pays It |

|---|---|---|---|

| Consumption | VAT (Value Added Tax) | 20% tax added to most goods and services in the UK. | Every consumer |

| Excise Duty | Applied on alcohol, tobacco, fuel, and sugary drinks. | End consumer | |

| Import Tariffs | Built into cost of imported goods — passed down in pricing. | Consumers indirectly | |

| Transport & Travel | Fuel Duty | ~53p per litre + VAT on top — one of the highest fuel taxes in the world. | Drivers and logistics businesses |

| Vehicle Excise Duty (Road Tax) | Annual charge for owning or operating a vehicle. | Vehicle owners | |

| Car Insurance Premium Tax | 12% tax added to insurance premiums. | Vehicle owners | |

| Driving Licence Fees | Cost to apply, renew, or replace your licence. | Drivers | |

| Toll Roads & Bridges | Charges for using certain roads, bridges, and tunnels. | Drivers | |

| ULEZ/Congestion/LEZ Charges | Urban driving fees (e.g., London ULEZ) for entering city zones with emissions restrictions. | City drivers | |

| Housing & Property | Council Tax | Monthly local authority charge, often increasing annually. | All households |

| TV Licence | Mandatory fee to legally watch live TV or BBC services. | Nearly all UK residents | |

| Stamp Duty | Tax on property purchases above £250,000. | Home buyers | |

| Communication | Mobile & Broadband VAT | 20% VAT applied to your phone and internet bills. | All users |

| Telecom Infrastructure Levies | Costs included in bills for maintaining broadband/mobile networks. | Users | |

| Business & Work | Business Licensing & Permits | Required for many trades: e.g., food hygiene, waste, signage, music licences. | Entrepreneurs, SMEs, and sole traders |

| Freelance Platform Fees + VAT | Freelancers pay platform commissions + VAT (e.g., Upwork, Fiverr). | Freelancers | |

| Banking & Finance | Inflation (Currency Devaluation) | A hidden “tax” as your purchasing power erodes year after year. | Everyone with savings or fixed incomes |

| Interest on National Debt | Tax revenue used to service government debt rather than provide services. | All taxpayers | |

| Leisure & Nature | Licensing Fees (Hunting, Fishing, etc.) | Even outdoor activities like fishing require state-issued licenses. | Anglers, hunters, campers, etc. |

| Environment | Plastic Bag Charge | 10p per bag, which adds up quickly with every shopping trip. | Every shopper |

| Investment | Captital Gains | 10-24% | Those trying to escape debt slavery |

| Inflation | Officially 3.6% | everyone holding fiat currency | |

| Death | Inheritance Tax | 40% on estates over £325,000 (unless exemptions apply). | Beneficiaries |

Even if you’re not paying income tax, you’re still being taxed at nearly every point of economic interaction—from eating and traveling to communicating and even dying. Your told that if you better yourself by educating yourself or skill acquisition you will earn more and finally be free, but when you do, they move the goal posts on you.

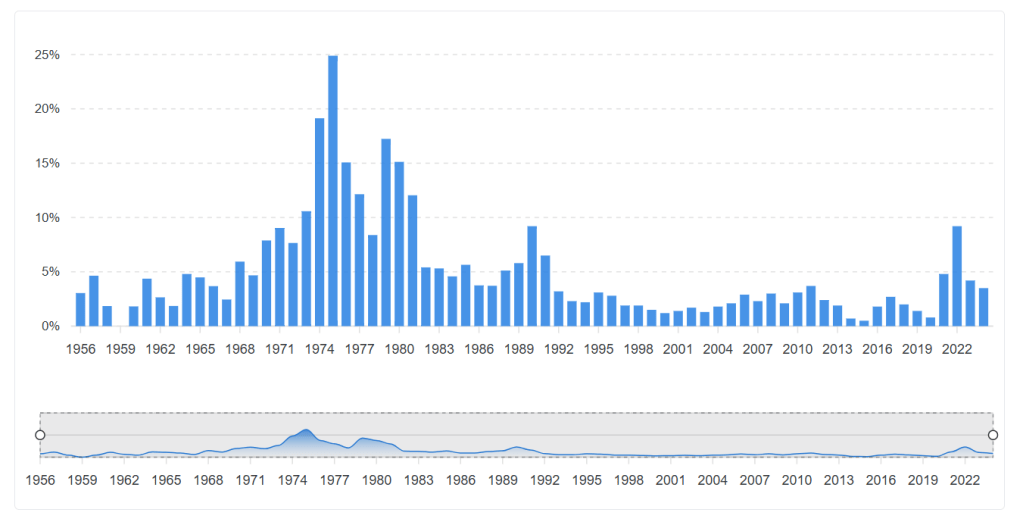

WHAT IS INFLATION?

Understanding inflation is one of the most critical steps to securing your financial future. While most people believe inflation simply means prices are rising, this is actually a symptom—not the cause.

The truth is, inflation is the steady devaluation of your currency—97% in the case of the British pound.

Every day that your money sits in a bank account, it loses purchasing power. And to make matters worse, the small amount of interest you might earn is taxed as income—even though it rarely keeps up with the official inflation rate.

In short: you’re being penalised for saving, and rewarded for spending or borrowing—a backwards system that traps the unaware.

CONCLUSION

Even if you don’t pay income tax, your existence is monetised. You’re taxed to:

- live in a home (Council Tax),

- move (Fuel + Road Tax),

- speak (Phone/Internet VAT),

- work (Licensing),

- and die (Inheritance Tax).

These aren’t “optional.” They are systemic—you are renting your life from the state.

Do you see why you feel like the system is stacked against you? It’s because it is!

WHY DOES THE GOVERNMENT ALLOW—OR EVEN ENGINEER—INFLATION?

It may seem counterintuitive, but the steady devaluation of currency through inflation isn’t a bug in the system—it’s a feature.

Modern governments operate on a debt-based economic model. That means they regularly borrow massive sums of money to finance current spending—from infrastructure and public salaries to military operations and welfare programmes. These debts are often issued in the form of government bonds with fixed repayment values.

Now here’s the trick: over time, inflation erodes the real value of those debts.

Let’s break it down:

- A government borrows £1 million today.

- In 10 years, due to inflation, that £1 million is worth far less in real purchasing power.

- But the repayment amount stays the same—meaning they’re effectively paying back that debt with cheaper, devalued money.

Meanwhile, the assets purchased (infrastructure, property, land, military hardware, etc.) increase in nominal value over time. So the government (and those connected to it) benefits from:

- Rising asset income (e.g. taxes, rents, or user fees)

- Fixed past debts that become easier to pay

This is the hidden engine of why those in power tend to be asset-rich. Their policies are designed to favour asset ownership—not labour or saving. Laws are created that protect and inflate the value of assets, while simultaneously allowing inflation to quietly erode the obligations of debt repayment.

This is also why middle-class savers get squeezed:

- You save cash? It devalues.

- You earn interest? It’s taxed.

- You get a raise? You enter a higher tax band.

- But if you own assets? You win—often tax-free.

Inflation, therefore, is not just an economic issue. It’s a silent redistribution mechanism—taking from the working class and giving to those who own and legislate—and that is why they do it.

THE CONTEXT

1. FINANCIAL HARDSHIP AND DECLINING AFFORDABILITY

Core Insight:

- The house-price-to-income ratio has exploded from ~3x in the 1980s to ~8–10x in the 2020s, depending on region.

- The cost of living in London, even in outer zones like Croydon (Zone 5), now requires a post-tax income that approaches or exceeds £40,000 just to survive.

- A single adult on an average salary struggles to cover both rent and a savings plan for home ownership.

| Item | Comment |

|---|---|

| 1985 house price vs. salary | ~£30,000 vs. ~£10,000–14,000 is broadly accurate. The average UK house price in 1985 was £35,000–£40,000, but this varied by region. The 2.5–3x income rule was standard. |

| 2024 average house price | Around £286,000 (UK average as of mid-2024). In London, it’s £525,000+, so ratios differ regionally. The 10x+ ratio in London is sadly accurate. |

| Current average salary | Median UK salary is ~£34,000 gross in 2024. Median London salary is closer to £41,000–£45,000. |

| A person could pay for house in 4 years | If they saved every penny. Living costs existed in 1985 too, albeit far cheaper. |

| Car lease, insurance, utilities | These figures are realistic approximations for middle-class London lifestyle (though a Golf or older Mercedes is not considered “basic”). |

| Savings for deposit (4.5 years) now | This timeline is accurate—if you have the required income to begin with—but it assumes disciplined savings and no life emergencies. And by the time one saves a deposit, prices will have risen again. |

| You will own nothing? | For many, ownership is out of reach, especially single-income households. |

2. WIDER SOCIETAL DECLINE AND STATISTICS

Trends Strongly Supported by Data:

- Food bank dependency: Trussell Trust data shows over 2.9 million parcels distributed in 2023–24.

- Temporary accommodation: 117,000+ families in temporary housing in 2024–record high.

- NHS backlog: 7.6 million people on waiting lists.

- Hospital bed reduction: Cut nearly in half over 30 years while population increased.

- Real wage stagnation: Wages are flat or even lower in real terms than 2007.

- Prison population: Rose from 44,000 to ~88,000 (2024), with overcrowding concerns.

- Child destitution: Triple increase–confirmed by Joseph Rowntree Foundation.

- Antidepressants: Increase from ~20 million in 1999 to over 85 million in 2022–23.

- Energy & Food poverty: While the elderly and vulnerable are being forced to choose between food on the table or staying warm, supermarket chains and energy companies are posting unprecedented profits. Energy usage has dropped by 20% while costs have risen in the same period.

IN ADDITION

- Crime Explosion: Once-thriving cities are descending into chaos. From rising knife crime and burglaries to organised gangs and drug-related violence, urban centres across the UK are being slowly ghettoised—social trust eroded, families displaced, and safety sacrificed on the altar of failed policy and moral decay.

- Income inequality: The UK has among the highest income inequality in the developed world.

- Productivity: UK productivity has stagnated, with growth well below historic averages. In addition, the cost to do business has risen significantly

- Emigration: The UK leads the world in capital flight and brain drain.

3. IMPACT ON RELATIONSHIPS AND FAMILY LIFE

- Dating and men’s roles: The idea that men feel economically “unviable” as providers is echoed in multiple sociological studies. Economic precarity is affecting male identity and delaying marriage/family formation. A women saying she wants a man making an 6-7 figure income is not necessarily being delusional. It seems to me a that women may in fact be intuiting the need for a high income to establish what used to be considered a normal or average family life.

- Family Collapse: Combining the two previous points leads us to a third. By 2030, Half of Women Aged 18–35 Will Be Single and Childless. These are considered to be the prime child bearing years, and is an warning light signaling societal collapse.

- Living with parents: Data from ONS shows over 3.5 million 20–34-year-olds still live at home. This is not just cultural—it’s financial.

- Family holidays: Parents pulling kids out of school early to avoid holiday pricing is well documented.

- Student loans: Repayment thresholds and interest rules have worsened. Many never finish repayment under the new system.

This cascade of symptoms is not random but deeply interrelated. It also explains the constant reference to “managed decline” in political corridors.

Cascades like this tend to occur when the foundational logic of a system—whether mechanical, financial, or societal—is corrupted beyond repair. At that point, the parts can no longer function independently; each failure begets the next. Rising crime, collapsing families, unaffordable living, chronic mental health decline, widespread debt, fertility collapse, and mass emigration are not isolated events—they are symptoms of an exhausted civilisation in retreat, a structure trying to hold form even as its inner scaffolding gives way.

Those who know know, and are profiting like vultures circling the the carcass of civilisation.

The leadership is no longer focused on fostering growth; they are now merely overseeing a controlled demolition—or, managed decline, as it is being referred to. This is the moment to seek higher ground, spiritually, mentally and materially, before the full weight of the coming hardship sets in. What lies ahead is not speculative; it is predictable. And unless you position yourself wisely, you will be swept up in the misery that follows.

“The name of the LORD [the Eternal] is a strong tower; the righteous man runs into it and is safe.” (Proverbs 19:10)

SPIRITUAL INSIGHT

We’re told to chase higher salaries. But even six figures are eroded by hidden costs. The lie isn’t just that we’re underpaid—it’s that money alone can free us.

“Why do you spend your money for that which is not bread? And your labor for that which does not satisfy?” (Isaiah 55:2)

God’s economy calls us back to justice and Jubilee.

- Build Sabbath into your life.

- Refuse debt as a lifestyle.

- Steward like a heir, not a slave.

It’s time to stop surviving in Babylon—and start ruling in Zion.

5-STEP GUIDE FOR CHRISTIANS TO EXIT THE SLAVERY ECONOMY

1. WAKE UP TO THE ILLUSION

You’re not behind because you’re lazy—you’re behind because the game is rigged. Hidden taxes, inflated costs, and stagnant wages have entrapped the masses. Even high earners lose more than half their income before they see a penny.

“My people are destroyed for lack of knowledge.” — Hosea 4:6

2. REDEFINE WEALTH IN GOD’S TERMS

Wealth is not accumulation; it’s authority, peace, and purpose. The Kingdom defines prosperity not by salary but by fruitfulness, generosity, and inheritance. Real wealth builds legacies, not liabilities.

3. RESET YOUR HOUSEHOLD ECONOMY

Cut Babylon’s cord. Ditch debt. Build margin. Use cash wherever possible. Own land. Seek God’s design for your home, vocation, and investment. Think like an heir, not a hustler.

4. WORK FOR PURPOSE, NOT PAY

Ask God: Is my labour building Pharaoh’s storehouses—or His tabernacle? Don’t settle for survival. Your work is meant to be a witness.

5. SOW INTO THE KINGDOM

You’re not called to self-rescue. You’re called to surrender. Giving isn’t losing—it’s leveraging. Sowing is how Heaven multiplies. Invest in what moth and rust cannot destroy.

5 QUESTIONS FOR REFLECTION

- Have I confused security with salary?

- What assumptions about money have I never questioned?

- How much of my income do I actually get to use freely?

- What is God calling me to build with my hands?

- Am I a citizen of God’s economy—or a captive of the world’s?

DEVOTIONAL PRAYER

Father,

Expose the counterfeit comforts and invisible chains I’ve accepted as normal. Give me eyes to see through the illusion. Break every agreement I’ve made with Pharaoh’s economy. Teach me to value what You value, and to labour not for bread alone but for eternal fruit.

Rebuild my mind, reframe my heart, and realign my household. Let me be a steward in Your Kingdom—not a slave in theirs.

In Jesus’ name, Amen.

KEY STATEMENT

If you earn more but still live in fear, you’re not FREE—you’re ruled.

MEMORY VERSE

“Unless the Lord builds the house, those who build it labour in vain.” (Psalm 127:1)

Leave a comment